In foodservice, decisions never happen in a vacuum. They happen between prep lists, deliveries running late, vendors texting price changes, and finance teams pushing for tighter margins. Every day, operators are swimming in data — invoices, sales numbers, inventory counts, contract pricing, usage trends — yet somehow still struggling to answer the simplest questions:

- Where is our money actually going?

- Why did costs jump this month?

- Which locations are over-ordering?

- Which SKUs are quietly eroding margins?

The problem usually isn’t lack of data — it’s lack of clarity. That’s where data visualization becomes a game changer.

Data visualization translates mountains of raw information into visuals that the human brain can instantly understand. Charts, graphs, and dashboards replace spreadsheets and guesswork, making patterns visible in seconds instead of hours. Instead of reacting to problems weeks too late, operators can spot issues early and take action fast.

When done right, data visualization becomes the lens that turns confusing numbers into confident decisions.

What Is Data Visualization?

Data visualization is the practice of turning complex data into visual formats that make trends, connections, and outliers easier to understand. It uses tools like dashboards, graphs, charts, and geographic maps to display information in a way that’s both faster to process and easier to interpret than rows of numbers.

In foodservice specifically, data visualization turns your purchasing, inventory, and pricing data into stories you can actually read:

- Rising chicken costs jump off the screen instead of hiding in spreadsheets.

- Location-to-location ordering gaps become instantly obvious.

- Contract price compliance becomes a clear “green or red” snapshot instead of an invoice scavenger hunt.

Visualization doesn’t remove the data — it gives it a translator so your operations and purchasing teams can act on it quickly and confidently.

Why Data Visualization Matters in Foodservice

Foodservice operators operate in a uniquely fast-paced environment where small changes can quickly become expensive problems. Rising commodity costs, inconsistent supplier pricing, portion drift, purchasing outliers, and freight fluctuations all influence margins daily.

Without visualization tools, most teams rely on manual processes to track these changes — pulling reports, checking invoices line by line, and attempting side-by-side comparisons that burn hours and still miss key trends.

Visualization tools eliminate that slow reaction cycle.

Instead of buried spreadsheets, operators get:

- Instant snapshots of spend trends by category, item, or location

- Visual alerts when pricing spikes outside of expected ranges

- Side-by-side comparisons across vendor networks

- Clear usage patterns to uncover inventory overages or menu inefficiencies

The result? Less guesswork, fewer surprises, and faster reactions to cost pressure.

Common Types of Data Visualization in the Foodservice Industry

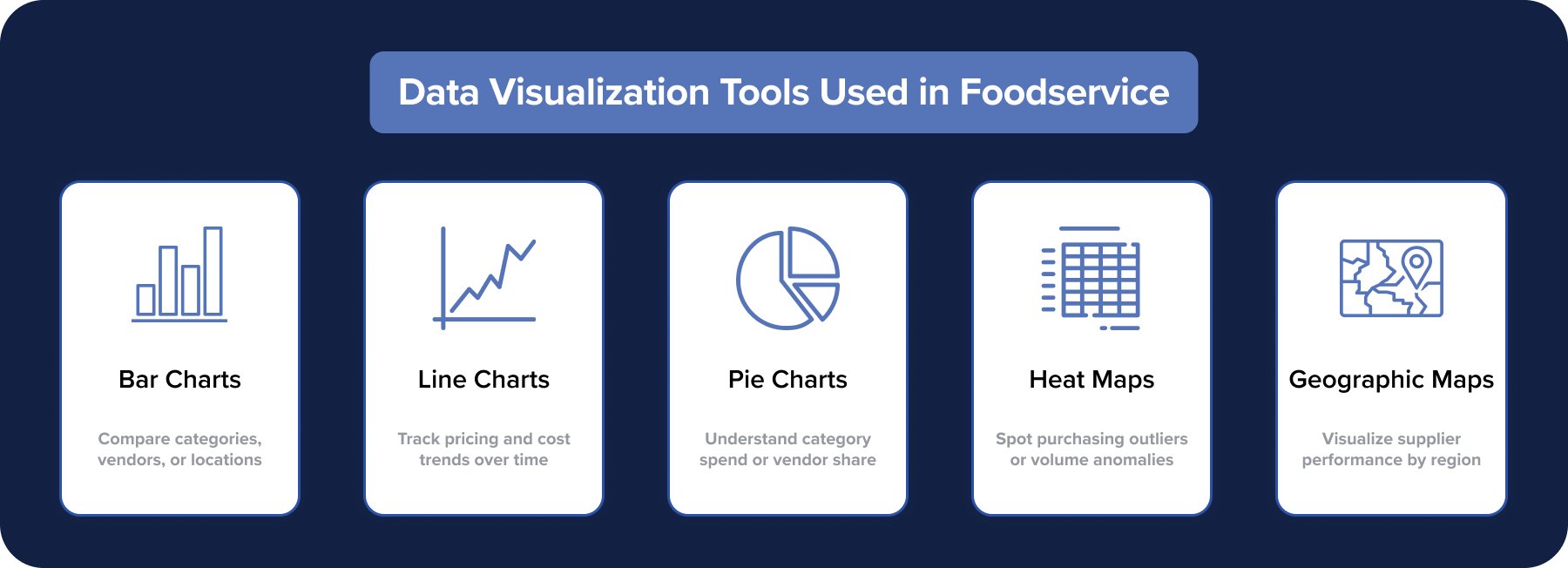

Not all images have the same meaning. The format you choose should depend on the story your data needs to tell.

Column and Bar Charts

Great for comparing categories, vendors, or the performance of a single unit. For instance, looking at how much each distributor spends on produce in different areas right away shows where prices are too high.

Charts with Lines

Great for keeping an eye on trends over time, like changes in the price of goods, the percentage of monthly food costs, or the changes in purchases during different seasons.

Visuals Like Pie Charts and Donuts

Best for showing proportions. These quickly show how much money is spent in each category or how much money a vendor has in their wallet.

Heat Maps

Use color to show areas or price ranges with a lot of or a little volume. These are useful for finding places where people buy things in strange ways or where the inventory isn’t always correct.

Maps of the World

Used to see regional data from many places or distribution zones, which makes it much easier to look at logistics and supplier coverage.

Each type helps turn big data sets into useful stories for the operations, finance, and sourcing teams.

The Real Benefits of Data Visualization for Operators

Making dashboards look nice is only one part of visualization. It adds value to operations that directly affects profits.

1. Better Control of Costs

Operators can change their buying strategies before costs rise by keeping an eye on category pricing from week to week. This lets them lock in pricing opportunities or change where they get their goods as markets change.

2. Finding Problems Faster

Dashboards show problems with volume, price, or compliance right away. You don’t have to wait until the end of the month to find out what has already gone wrong.

3. Stronger Budget Management

Visualization tools show how much money is being spent compared to budget goals in real time. This lets managers make changes while the month is still going on, not after they have already spent too much.

4. Location-to-Location Consistency

Operators in charge of multiple brands use dashboards to make sure that stores follow the same rules for buying, limit off-contract purchases, and make sure that all stores use the same products.

5. Communication Between Teams That Is Clear

Instead of complicated financial reports, leadership shares clear visuals that tell a simple story. This keeps everyone in operations, finance, and procurement on the same page about what needs to be done.

Data visualization breaks down barriers and gives you confidence instead of confusion.

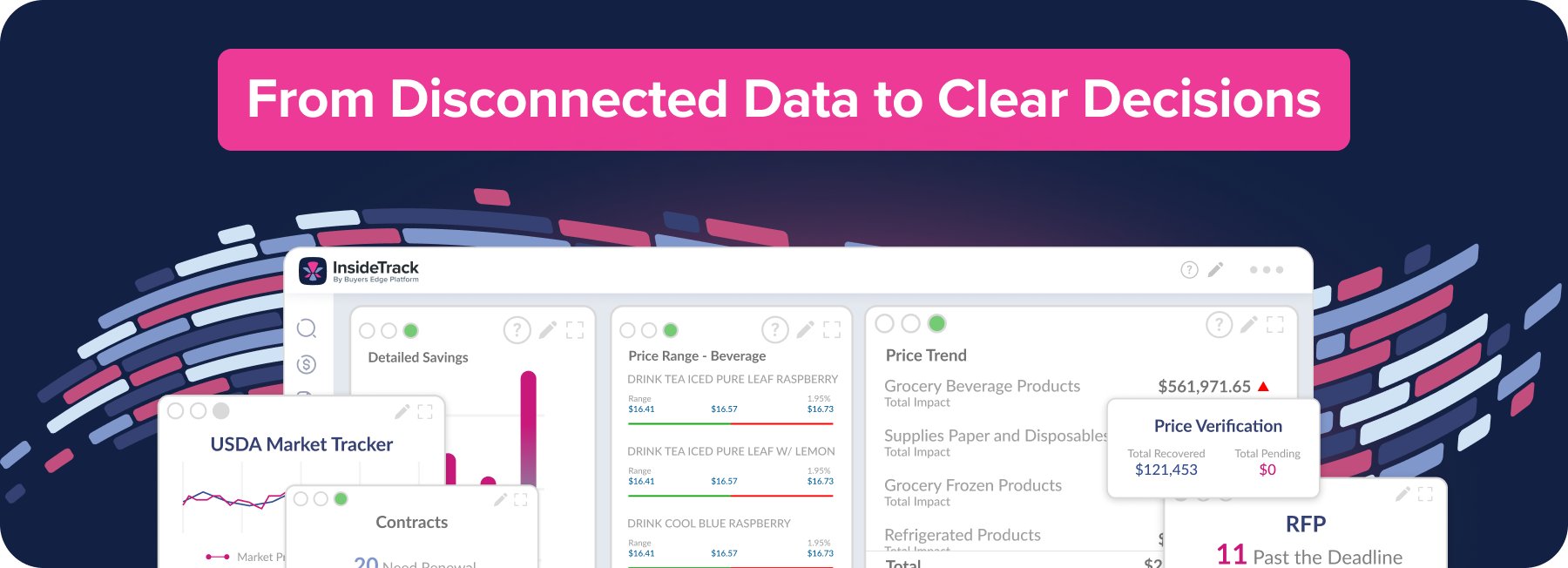

Data Visualization Solutions with InsideTrack

This is where InsideTrack comes in.

InsideTrack takes buying information from many different distributors, vendors, and locations and puts it all on one standardized platform. Instead of dealing with mismatched spreadsheets and PDF invoices, operators can use powerful visualization dashboards that sort spending by:

- Category or type

- Descriptions of items

- Locations

- Distributors and vendors

- Price changes over time

The end result is a completely clear picture of purchases that is simple to look at, understand, and act on.

Actionable Insights InsideTrack Provides

Using InsideTrack dashboards, foodservice operators can unlock insights that drive smarter sourcing decisions every day.

Price Trend Analysis

Track item and category price movement week over week to anticipate cost shifts rather than react to surprises.

Price & Volume Variance Reporting

Instantly surface where pricing deviates across vendors or volumes drift away from expected purchasing patterns.

Descending Dollar Reports

Prioritize savings opportunities by instantly identifying top spend drivers across your business.

Budgeting & Spend Tracking

Visual dashboards allow teams to monitor real-time spending against targets, improving financial discipline and forecasting accuracy.

These tools turn data from something you react to into something you control.

From Visualization to Profit Protection

InsideTrack does more than just show charts and dashboards.

InsideTrack keeps a digital, searchable record of every line item on every invoice, giving procurement teams an unprecedented look at how people buy things. Operators start with high-level visuals that show trends and red flags. Then they look at specific SKUs, contracts, and vendor relationships to see what is causing the numbers.

Brands can do the following with this deeper visibility:

- Make the best use of product mixes

- Make sure contracts are followed

- Check how well the distributor is doing

- Fix margin leakage before it gets worse.

Visualization opens the door to detailed buying information that keeps profits safe.

Turning Data into a Strategic Advantage

Data visualization is no longer a “nice-to-have” tool for foodservice operators. It’s essential for staying ahead of volatility, scaling purchasing across locations, and running leaner operations in a market where margins remain under pressure.

With InsideTrack’s advanced visualization dashboards, operators don’t just see their data — they understand it, trust it, and use it to make smarter decisions every day.

Because clearer data means clearer decisions — and clearer decisions build stronger bottom lines.